- From: <steve.e.magennis@gmail.com>

- Date: Tue, 10 Aug 2021 07:30:16 -0700

- To: <daniel.hardman@gmail.com>, "'Joosten, H.J.M. \(Rieks\)'" <rieks.joosten@tno.nl>

- Cc: "'Michael Herman \(Trusted Digital Web\)'" <mwherman@parallelspace.net>, "'public-credentials'" <public-credentials@w3.org>

- Message-ID: <062001d78df4$3d468f50$b7d3adf0$@gmail.com>

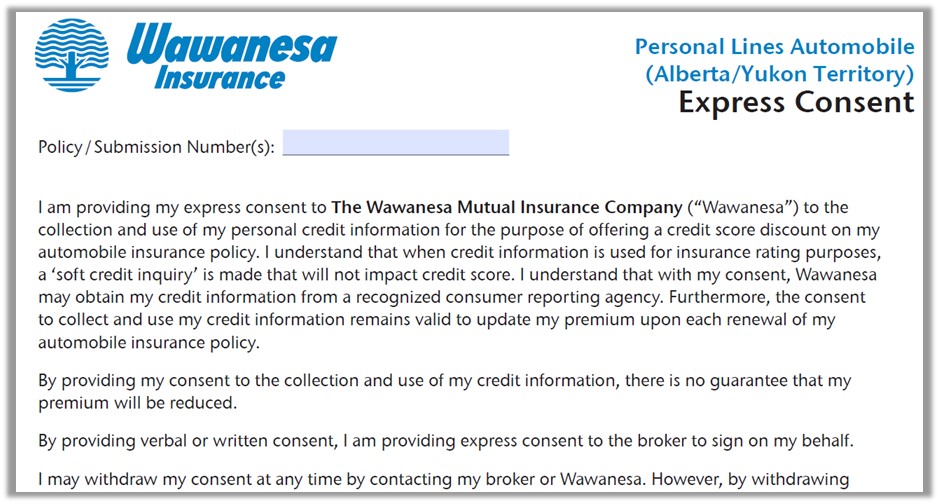

Having been involved with this industry I learned a couple of really interesting things. First, the quants at major carriers typically find that just a handful of data points drive a large statistical correlation between an individual and the likelihood they will make a claim (for common insurance like auto, home, etc). There has been a fever pitch the last 7 years or so to see if it is possible to squeeze any better correlation (i.e. profits) using ML against large data sets and lots of data points. Some have been successful, some less so. Nobody has found anything that challenges the core analytic models though. Another common path towards seeking increased profits is the other technique mentioned of customizing insurance based on the risk of an individual. This is done all the time for things like the Fyre Festival, Adel’s voice, Ichiro’s arm. Generally though, insurance works when you have a (risk) pool of people (or assets) that are all equally likely to experience a loss event where the loss would be hard for any one party to absorb. Effectively sharing the pain, but also sharing ‘peace of mind’. The quants define risk pools, figure out the cost to the risk in that group, add X% administrative overhead and profit, divide by 12 and you have your monthly premium. The problem is that for any group of people the risk is not distributed equally. So the thinking goes: know more about the individual, know more about the risks AND now you can have more, smaller, more precise risk pools or even customize premiums to an individual. Riskier people pay more, less risky people pay less – simple. In the US though many approaches to this type of modeling was actually prohibited. The reason being there was a fear (among other reasons like privacy) that the analytics and granular pricing would work too well. The thinking behind this is that if a carrier is able to precisely identify the risk profile for small groups or even down to the individual level (i.e. driving monitor), the carrier can effectively and selectively push risk back onto the customer. An individual that statistically will never make a claim gets a really low premium, but statistically they will never make a claim so insurance is of little value to them (statistically). An individual that statistically is going to make a lot of claims gets a really high premium, so high that all they are really doing is paying an insurance company a fee for administering a rainy day savings account on their behalf. If a carrier is able to de-risk their risk pool using ML and custom premiums, they can make more profit and lower their risk of operations. In the US and many other parts of the world the amount of risk a carrier assumes is regulated so at least in the aggregate the carrier can’t just collect premiums but have no business risk and provide no protection. -S From: Daniel Hardman <daniel.hardman@gmail.com> Sent: Tuesday, August 10, 2021 1:39 AM To: Joosten, H.J.M. (Rieks) <rieks.joosten@tno.nl> Cc: Michael Herman (Trusted Digital Web) <mwherman@parallelspace.net>; public-credentials (public-credentials@w3.org) <public-credentials@w3.org> Subject: Re: How much extra in terms of Cost of Living are you willing to pay to be able to continue to exercise Self-Sovereign control over your personal data? Yeah. I've been seeing these types of offers in the US for the past couple years. Usually they are more similar to the ones Rieks mentioned, where the discount is based on driving data. But I have also seen the variant Michael mentioned, based on credit score. I think it's reasonable to offer a discount based on better data about driving habits. Credit score, maybe not so much (though I'm sure a data scientist could justify it). But the thing that bothers me about all of them is that there's no constraint on fitness-for-purpose; you consent to have the data analyzed, but there's always some kind of "oh, and by the way we'll also use the data to tailor other offers to you" proviso that makes it into a Hobson's choice. Very frustrating. On Tue, Aug 10, 2021 at 8:25 AM Joosten, H.J.M. (Rieks) <rieks.joosten@tno.nl <mailto:rieks.joosten@tno.nl> > wrote: I’m not sure how that is in other countries; in the Netherlands various insurance companies offer discounts of up to 35% discount on your premium if you agree to share your driving habits (collected through a dongle or a smartphone app). The Duthc consumerorganization has a (Dutch) article <https://www.consumentenbond.nl/autoverzekering/korting-voor-je-rijstijl> (Google Translate may be your friend here) explaining the consequences (including that such data may be subpoena’d by police). While the idea is that ‘safe drivers’ get a discount, the premium over which the discount is applied is higher than a regular/equivalent policy. Since data appears to have many uses beyond the consumer’s imagination, there is a case to be made for purpose binding (as mentioned in the GDPR), and technology/protocols to be developed that contribute to the enforcement thereof. Rieks From: Michael Herman (Trusted Digital Web) <mwherman@parallelspace.net <mailto:mwherman@parallelspace.net> > Sent: dinsdag 10 augustus 2021 03:07 To: public-credentials (public-credentials@w3.org <mailto:public-credentials@w3.org> ) <public-credentials@w3.org <mailto:public-credentials@w3.org> > Subject: How much extra in terms of Cost of Living are you willing to pay to be able to continue to exercise Self-Sovereign control over your personal data? My car insurance renewal comes up next month and I received this “offer” from my local insurance agent: Wawanesa doesn’t explain how or why they need a person’s credit score. A little digging unearths this gem of an article: https://www.experian.com/blogs/ask-experian/why-do-car-insurance-companies-base-their-rates-on-credit-scores/ Also: * https://www.wawanesa.com/resources/docs/canada/NS_CreditConsent_CustomerFAQ-en_13Jan2021-FIN.pdf * https://www.cbc.ca/news/credit-scores-can-hike-home-insurance-rates-1.890442 How much extra in terms of Cost of Living are you willing to pay to be able to continue to exercise Self-Sovereign control over your personal data? Best regards, Michael Herman Far Left Self-Sovereignist Self-Sovereign Blockchain Architect Trusted Digital Web Hyperonomy Digital Identity Lab Parallelspace Corporation This message may contain information that is not intended for you. If you are not the addressee or if this message was sent to you by mistake, you are requested to inform the sender and delete the message. TNO accepts no liability for the content of this e-mail, for the manner in which you use it and for damage of any kind resulting from the risks inherent to the electronic transmission of messages.

Attachments

- image/jpeg attachment: image001.jpg

- image/jpeg attachment: image002.jpg

Received on Tuesday, 10 August 2021 14:30:34 UTC