- From: Dimitri De Jonghe <dimi@bigchaindb.com>

- Date: Mon, 20 Jun 2016 10:58:33 +0200

- To: David Fuelling <dfuelling@sappenin.com>

- Cc: Dimitri De Jonghe <dimi@bigchaindb.com>, Interledger Community Group <public-interledger@w3.org>

- Message-ID: <CADkP8Cr1WKmU9ecjNKLqKNreWededWN5YwKOUe_RAfMA4dd7Bw@mail.gmail.com>

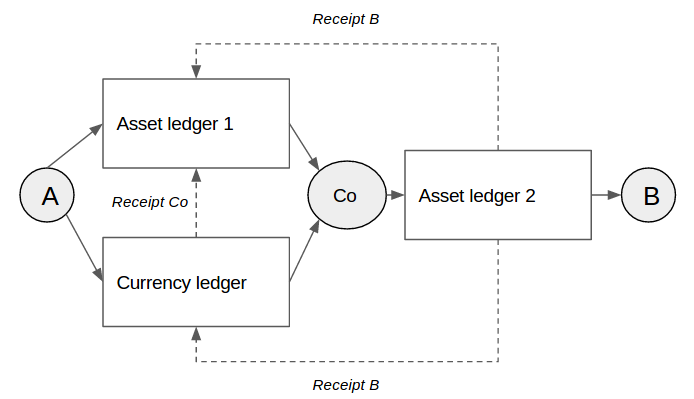

Hi David, > Indeed, this has been on our minds also. I think there are few possible >> scenarios, and I can imagine our community to come up with even better ones. >> In general, one would like to see a payment receipt for the charges in >> order to transfer the shares. Hence the traders would need to connect - >> besides their shares ledger - to an ILP compatible payment ledger. >> > > This is an interesting approach -- it seems like you're proposing that the > coordination of, in my example, the "share" transfer and the > "currency/commission" transfer be done outside of ILP? Or am I mis-reading? > > I was trying to think about how a sort of "commissioning" system could be > accomplished *inside* of ILP, maybe as an associated "side-car" transfer or > something like that. So, if I transfer 10 shares of XYZ, I could also > specify an additional transfer in currency to *pay* a connector for the > share transfer (?) > > Without something done *inside* of ILP, it's difficult for me to see why a > connector would fulfill an ILP transaction that they can't profit from > (i.e., a non-currency transfer), which tends to limit ILP to either systems > that coordinate commission payments independently and outside of ILP, *or*, > a global ILP system that only handles things like currencies that can be > fungibly "commissioned" by deducting a certain fee from the transfer. > > I'm curious to hear any other thoughts from the community around this > topic of connector "fees." > > My proposal is to everything inside ILP, but to hook up a mix of ledgers, see image [image: Inline afbeelding 1] The asset ledgers could be of the same type or of different types. In parallel the fee would be placed in escrow between the originator A and the connector Co. This would mean, that in order for B to redeem the asset, He would need to present a receipt to the Connector (Co). Once B redeemed the asset, then Co can redeem the fee and the asset on ledger 1. All the receipts are encoded using the ILP fulfillment URI's (which is a serialization of the ILP crypto-conditions <https://interledger.org/five-bells-condition/spec.html>). The execute condition of the escrow of asset ledger 1 would contain both receipt B as well as receipt Co. > The payment ledger would then create an ILP fulfillment URI to fulfill the >> shares transfers that are in escrow. It's still a bit vague but it would be >> truly cool if we can spin up a demo for this. (Actually I would be >> interested in doing so on the ILP hackaton 6/july in London). I can imagine >> many more use cases that would follow such a pattern >> >> > Can you give more specifics here - I'm somewhat new to ILP, and not > familiar with the notion of a "fulfillment URI." Is this your term, or > something from ILP? > See above > > But ILP allows to connect homogeneous ledgers of various asset types, >> given there are suitable connectors/exchanges. The latter will be an >> interesting topic for ILP. >> > > Can you elaborate more on this idea? Is this idea to chain the share > transfer and a commission into a single ILP transaction somehow? > > I guess there are multiple ways to mix asset ledgers with currency ledgers - besides the parallel approach above. One can think of liquidation of the asset in an intermediate ledger. eg: <A> --- assets ledger --- <Co1> --- currency ledger --- <Co2> --- asset ledger --- <B> > Moreover, it would be interesting if there would be a formal registry of >> asset types. >> > > Agree, although it seems like this might already exist for certain types > (e.g., for currencies ISO-4217 <https://en.wikipedia.org/wiki/ISO_4217>). > I suppose there must be other existing standards for various asset classes, > but it could be an interesting sub-project in the ILP work to consider > standardizing something like "classes" of asset. For example, "currency", > "bond", "stock", "ticket", etc, and then potentially delegate to existing > standards for specific types of each class (e.g., "currency" is defined by > ISO-4217, etc). > Yes, In fact we are working on an Intelectual property spec (COALA IP <https://www.w3.org/2016/04/blockchain-workshop/interest/mcconaghy.html>, under construction) for formally defining media licenses, together with IPFS <https://ipfs.io/>, IPLD <https://github.com/bigchaindb/py-ipld>, and the LCC framework of the copyright hub <http://www.rdi-project.org/#!faq/c11lh>. > Thanks for all of your input and answers -- it's a fascinating topic! > > 100% agreed, would be great to see the thoughts from the rest of our bright community... Cheers, -- Dimitri De Jonghe, PhD Developer +49 157 5946 2122 | Twitter <https://twitter.com/DimitriDeJonghe> | LinkedIn <https://www.linkedin.com/in/dimitridejonghe> | GitHub <https://github.com/diminator> | S <https://facebook.com/>kype: dimi.dejonghe [image: Logo] <https://www.bigchaindb.com/> BigchainDB GmbH Wichertstr. 14a, 10439 Berlin | Managing Director: Bruce Pon | Registered in Berlin HRB 160856B |info@bigchaindb.com | www.bigchaindb.com

Attachments

- image/png attachment: image.png

Received on Monday, 20 June 2016 08:59:14 UTC