- From: Evan Schwartz <evan@ripple.com>

- Date: Wed, 21 Jun 2017 13:17:38 +0000

- To: Michiel de Jong <michiel@unhosted.org>, Adrian Hope-Bailie <adrian@hopebailie.com>

- Cc: Interledger Community Group <public-interledger@w3.org>

- Message-ID: <CAONA2jWL9S9sagtKEoN_WByRA0GhATzAf2_RgOJSX08u=6WrrA@mail.gmail.com>

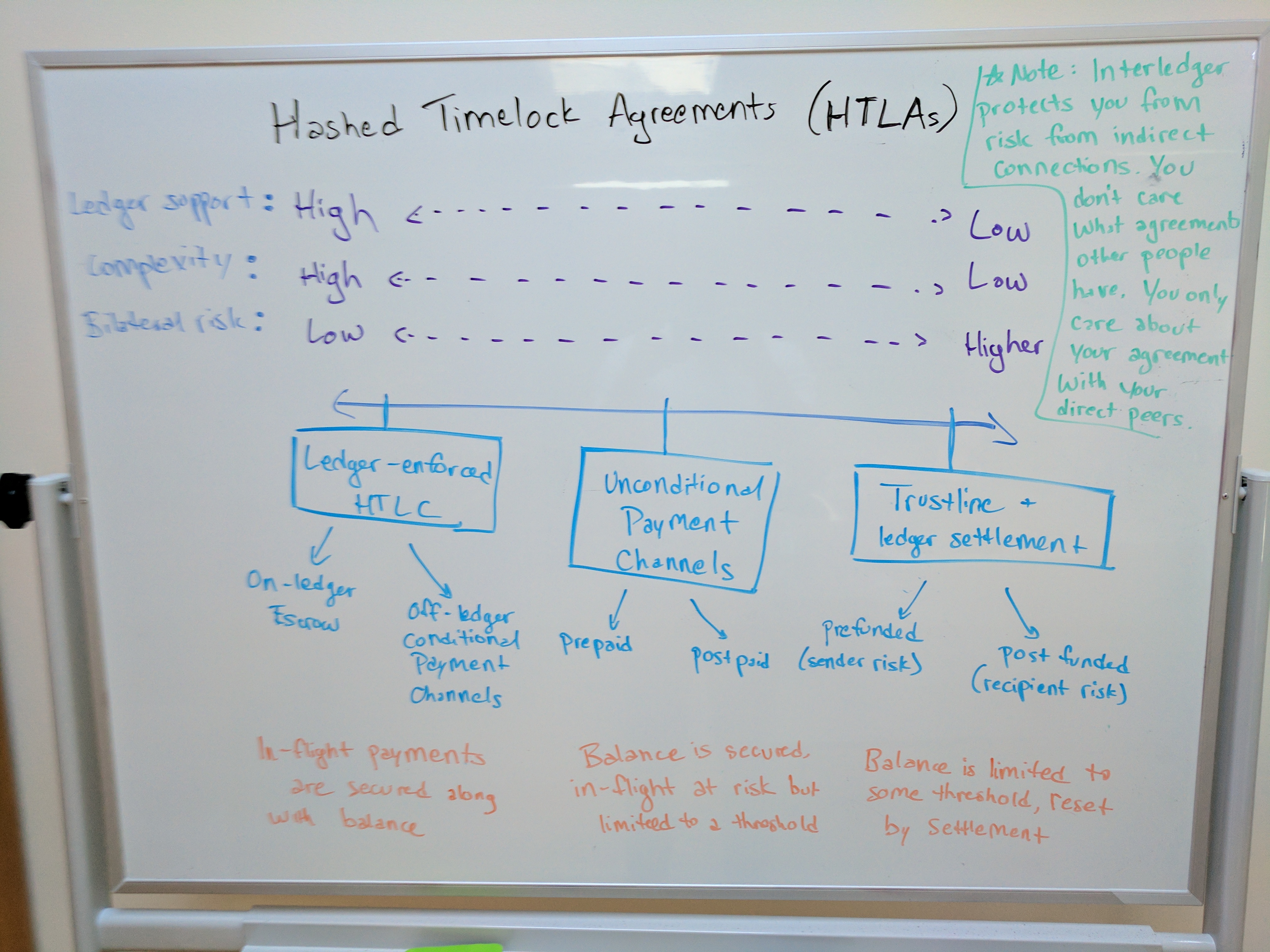

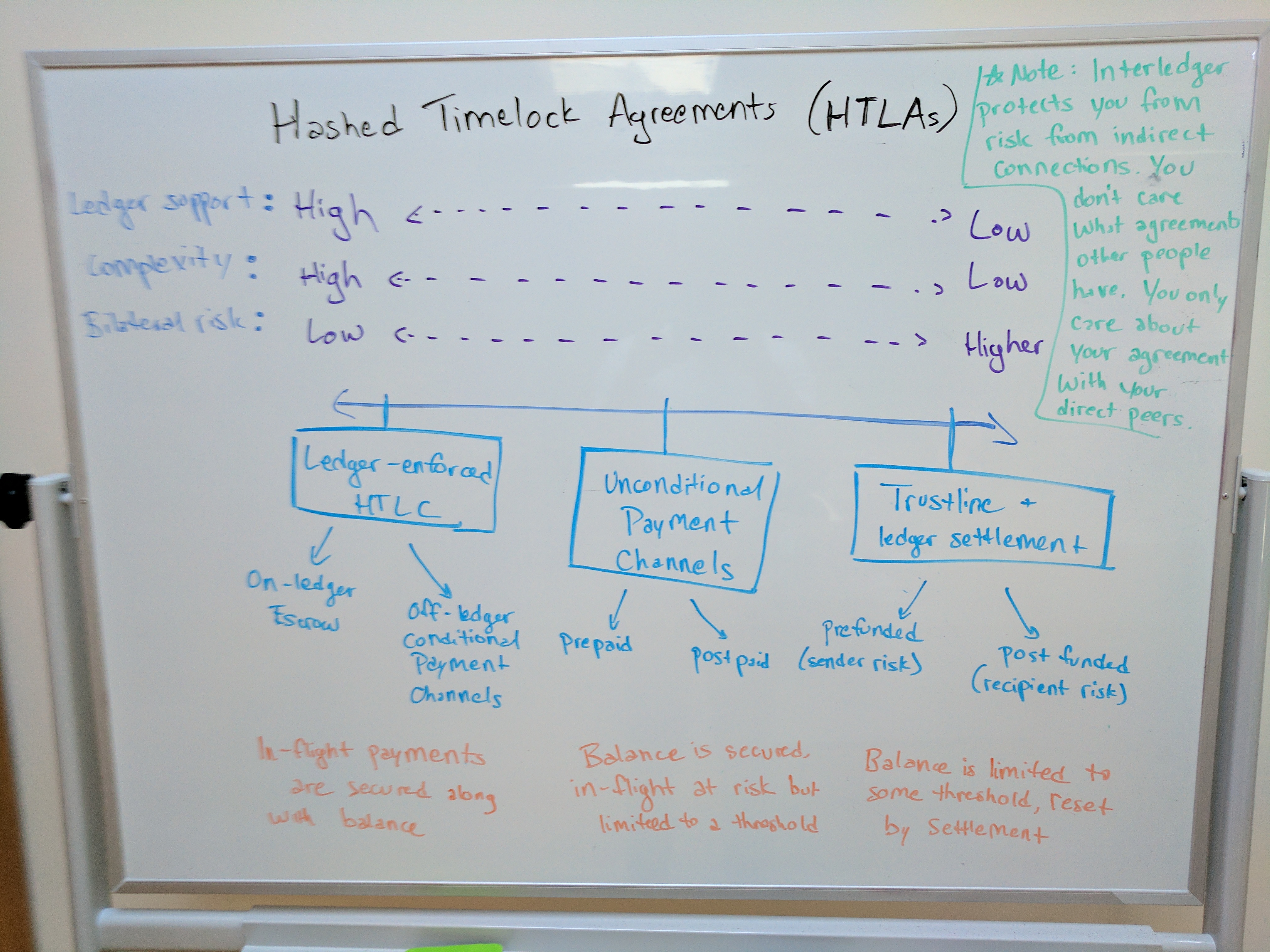

This time with the picture (inline and as an attachment, hopefully one goes through): [image: IMG_20170621_151002.jpg] On Wed, Jun 21, 2017 at 3:13 PM Evan Schwartz <evan@ripple.com> wrote: > This is the way I would draw the spectrum of possible agreements: > > [image: IMG_20170621_151002.jpg] > > There's a tradeoff between complexity / ledger support required and > simplicity + bilateral risk. Not sure which one will end up being the most > used but I think it's very cool that Interledger supports all of these > equally well. > > On Wed, Jun 21, 2017 at 12:31 PM Michiel de Jong <michiel@unhosted.org> > wrote: > >> I also like the term HTLA, it really explains the *per-hop* decision to >> use on-ledger, off-ledger (payment channel), or "no ledger" (just trust). >> >> On Wed, Jun 21, 2017 at 12:22 PM, Adrian Hope-Bailie < >> adrian@hopebailie.com> wrote: >> >>> I like it. Based on your description it sounds like there are 3 types of >>> agreement, it would make sense to probabaly define each and also document >>> the differences: >>> >>> 1. Agreement enforced by ledger >>> 2. Agreement by sender to complete transfer upon receipt of preimage >>> 3. Agreement by receiver to reverse transfer upon expiry >>> >>> I'd discourage use of 3 unless under specific circumstances because >>> there are usually fees involved in a reversed transfer which complicates >>> things a lot. >>> >>> On 21 June 2017 at 12:09, Evan Schwartz <evan@ripple.com> wrote: >>> >>>> What do you think about the term "Hashed Timelock Agreements (HTLAs)"? >>>> >>>> An HTLA is a generalization of the idea of a Hashed Timelock Contract >>>> (HTLC), which is the Bitcoin/Lightning Network term for conditional >>>> transfers where the conditions and timeouts are enforced by the ledger. >>>> >>>> In Interledger, you don't need all transfers to be enforced by the >>>> ledger, because two parties can treat an unconditional transfer on a ledger >>>> or through a simple payment channel as conditional. Basically, the two >>>> parties are using an agreement based upon a hashlock and a timeout where >>>> they say "if you give me the preimage to the hash before the timeout, I'll >>>> send you the corresponding payment". In that case the recipient takes the >>>> risk, but you could set up the agreement the other way where the sender >>>> must send the amount upfront and the recipient will send the money back if >>>> the transfer times out. Both parties can limit the amount of risk their >>>> peer poses simply by capping the amount they are willing to have unsettled >>>> or inflight. >>>> >>>> A key point about the security model is that if you use HTLAs to secure >>>> multi-hop transfers (like both Interledger and Lightning do) it's up to >>>> each pair of participants what type of agreement they want to use. If they >>>> have very little trust and their ledger supports more complicated features, >>>> maybe they want to use ledger-enforced HTLCs. If they are friends or have a >>>> business relationship or their ledger doesn't support enforcing HTLCs then >>>> a different type of HTLA would work just fine. >>>> >>>> What do you think? Does HTLA get the point across? (If this idea seems >>>> interesting or could use more explanation I could write up a full blog post >>>> about it) >>>> -- >>>> >>>> Evan Schwartz >>>> Software Engineer >>>> Managing Director of Ripple Luxembourg >>>> >>> >>> >> -- > > Evan Schwartz > Software Engineer > Managing Director of Ripple Luxembourg > -- Evan Schwartz Software Engineer Managing Director of Ripple Luxembourg <http:> <http:>

Attachments

- image/jpeg attachment: IMG_20170621_151002.jpg

- image/jpeg attachment: 02-IMG_20170621_151002.jpg

Received on Wednesday, 21 June 2017 13:18:31 UTC